|

|

Taxation for the 21ST Century:

the automated payment transaction (APT) tax Edgar L. Feige Professor of Economic Emeritus University of Wisconsin-Madison Economic Policy, October 2000 http://goo.gl/yU62AY Abstract No single coherent conceptual framework organizes the state's overall revenue collection function. The APT tax system seeks to provide such a framework by extending the logic of normative tax principles to all available tax instruments. The APT tax encompasses all prior taxes and subsumes them in the rubric of a singular tax structure. Revenue neutrality, base broadening, rate reduction, simplicity, transparency, equity, allocative efficiency and minimization of administrative and compliance costs are the principles that have guided the design of this apt new tax system. Summary This paper examines the desirability and feasibility of replacing the present system of personal and corporate income, sales, excise, capital gains, import and export duties, gift and estate taxes with a single comprehensive revenue neutral Automated Payment Transaction (APT) tax. In its simplest form, the APT tax consists of a flat tax levied on all transactions. The tax is automatically assessed and collected when transactions are settled through the electronic technology of the banking/ payments system. The APT tax introduces progressivity through the tax base since the volume of final payments includes exchanges of titles to property and is therefore more highly skewed than the conventional income or consumption tax base. The wealthy carry out a disproportionate share of total transactions and therefore bear a disproportionate burden of the tax despite its flat rate structure. The automated recording of all APT tax payments by firms and individuals creates a degree of transparency and perceived fairness that induces greater tax compliance. Also, the tax has lower administrative and compliance cost. Like all taxes, the APT tax creates new distortions whose costs must be weighted against the benefits obtained by replacing the current tax system. ---Edgar L. Feige 1. INTRODUCTION

Technological innovations in finance and communications have internationalized financial activity and created a virtual worldwide commerce. Institututional adaptations to these radical changes may ultimately require some form of global financial architecture. Today’s taxation schemes are based on personal incomes, corporate profits and expenditures, generated within national borders. However, massive reductions in transaction costs render these borders increasingly porous. Capital mobility, transfer pricing, off shore tax havens, tax competition, Internet commerce and the creation of global equity exchanges make it more and more difficult to identify and assess the national origins of income and profits and to tax them (see, for instance, The Economist, ‘The mystery of the vanishing taxpayer’, January 29, 2000). Taxation on a global scale offers a technological solution, but the politics of taxation and fiscal sovereignty remains an essentially national matter. At the national level, there is deep dissatisfaction with existing tax systems. They are viewed as overly complex, opaque, inefficient, inequitable, and costly to administer. The United States considers flat rate consumption taxation. Europe debates the wisdom of ‘fiscal harmonization’ and Japan contemplates radical institutional changes including major tax reforms. This reexamination of fiscal institutions should include consideration of replacing existing tax systems with a flat rate tax on all transactions as a means of simplifying and improving taxation in the 21st century. The politics of tax reform must proceed at the national level but there are great network externalities to be reaped from the coordination of similar tax structures in different countries. This paper proposes to eliminate the present system of personal and corporate income taxes, sales, excise, capital gains, gift and estate taxes, and to replace them with a single comprehensive revenue neutral Automated Payment Transaction (APT) tax that is simple, transparent, efficient and equitable. The author is under no illusion that such a radical proposal will be readily implemented. Rather, it is hoped that the proposal will spark international debate and research on a fresh set of issues in public finance and monetary economics. 2. AN OVERVIEW OF THE APT TAX PROPOSAL The foundations of the APT tax proposal involve simplification, base broadening, reductions in marginal tax rates, the elimination of tax and information returns and the automatic assessment and collection of tax revenues at payment source. The APT tax proposes to extend the tax base from income and consumption to all transactions, to eliminate tax expenditures in favor of direct government expenditures, and to rely on the skewness of the tax base rather than on the progressivity of the tax rate structure to insure equity. The APT tax can be viewed as a public brokerage fee accessed by the government to pay for the provision, maintenance and use of the monetary, legal, and political institutions that facilitate and protect market trade and commerce. The new tax system is designed solely to raise government revenue. We intentionally avoid the contentious issue of how large the government “should be” by requiring a revenue neutral tax that raises the same amount of revenue as is raised by the system of taxes that the APT tax is intended to replace. Simplicity is achieved by requiring that all final party transactions be taxed at the same ad valorem rate. Since every transaction must be settled by some means of final payment, taxes are routinely assessed and collected at source through the electronic technology of the automated banking/payment clearing system at the moment that economic exchange is evidenced by final payment. This automatic collection feature eliminates the need for individuals and firms to file tax and information returns. Real time tax collection at source of payment applies to all types of transactions, thereby reducing administration and compliance costs as well as opportunities for tax evasion. The simplicity of this apt tax derives from its flat rate structure applied to all final party transactions evidenced by payment with a final medium of exchange such as currency or a debit or credit to a transaction account. By eliminating all deductions, exemptions and implicit tax expenditures, the APT tax replaces the complexity and opacity of the current system with comprehensibility and transparency. Elimination of tax expenditures and special interest loopholes reduce incentives for rent seeking tax-lobbying behavior while clarifying tax incidence. The political burden of determining the allocation and distribution of government spending shifts entirely to the more transparent budget expenditure process. The variety of existing tax instruments, modes of collection, and the complexity of tax law have created an opaque tax system in which the determination of effective tax incidence is virtually impossible. Stiglitz (1986) suggests that politicians prefer such ambiguities “precisely because it is not clear who pays the tax." Informed private and public decisions concerning both the size of government expenditures and their distribution require a transparent tax system that fairly establishes each citizen's total tax burden. The APT tax collection system provides greater transparency automatically since individuals and firms need only consult the total debits to their tax payment accounts (TPA) to determine their total tax payments. By greatly broadening the current tax base, the APT tax permits a significant reduction in the marginal tax rates on currently taxed incomes and expenditures. It therefore recaptures many of the deadweight efficiency losses of the current tax system. Most important among these is a reduction in marginal tax rates on labor income that now accounts for roughly 75 percent of national income. The requirement of revenue neutrality implies that many utility producing voluntary transactions (primarily exchanges of financial property rights) that are presently untaxed, will now be taxed. These new tax wedges will induce new allocation distortions and distribution consequences that require further evaluation. The equity and fairness of the APT tax system depend upon its tax base, which is more highly skewed than the conventional income or consumption tax base (see Section 4). The wealthiest portion of the population executes a disproportionate share of total transactions whereas the percent of transactions undertaken by the poorest members of society is very small relative to their proportion in the population. The equity characteristics of the APT tax are determined by the skewness of the transaction tax base, rather than through progressivity in the tax rate structure. Because the APT tax is revenue neutral, it must, by definition, transfer the same amount of real resources from the public to the government, as does the present tax system. However, if this resource transfer can be undertaken at substantially reduced cost, without imposing greater net efficiency losses, it is welfare enhancing. Indeed we will argue that the replacement of the current tax system will eliminate larger distortions than will be introduced by the new APT system. The intuition behind this conjecture relies on the fact that base broadening permits a corresponding reduction in the marginal tax rates imposed on currently taxed transactions. Excess burdens fall non-linearly with reductions in the marginal tax rates on these presently heavily taxed transactions. These gains are of course partially offset by the introduction of tax rates on transactions that previously escaped taxation. The APT tax radically alters the composition of the transactions that make up the tax base. The current system primarily taxes transactions associated with income production and consumption. The largest portion of the APT tax base consists of wealth transferring and wealth redistributing transactions. The introduction of marginal tax rates on these latter activities will certainly have allocation consequences. By creating a tax wedge between the bid and ask prices of financial assets, the APT tax provides incentives to lengthen the average holding period of financial instruments. It will also increase the costs of hedging risk, of undertaking arbitrage and of speculating in financial markets. But as will be developed below, at least some of these allocation effects may actually be socially desirable, particularly where some of the newly taxed activities can be shown to produce negative externalities that can result from excessive volatility (see section 6.4. for a discussion). The net efficiency of the APT tax proposal must be evaluated by comparing its relative benefits and costs. Ballard, Shoven and Whalley (1985) employing computational general equilibrium models to determine the welfare effects of all major taxes in the United States, estimated that marginal deadweight costs amount to from 17 to 56 percent of revenue raised. Jorgenson and Yun (1991) estimated that the post 1986 tax reform system imposed a marginal efficiency cost of 38 percent of tax revenue and an average efficiency cost of 18 percent of tax revenue. The greatest efficiency benefit of a revenue neutral APT tax is the elimination of distortions imposed by the current tax system that the APT tax is intended to replace. Further gains are the substantial cost savings assured by the improved efficiency of the APT assessment, collection and enforcement mechanisms that reduce administrative and compliance costs. As with any tax system, the APT tax introduces its own costs and distortions. Among the possible distortions we must include cascading effects on intermediary transactions that induce vertical integration; loss of liquidity in financial markets; a reduction in short term arbitrage transactions; a lengthening of the term structure of debt and the holding period of financial assets; reductions in asset valuations resulting from the capitalization of future APT tax liabilities; incentives to seek payment substitutes and off shore tax havens and the transitional costs of moving to a new tax system. Some economists1 have suggested that the painlessness of APT tax collection could also reduce public resistance to the growth in government – the Leviathan issue in public choice theory. The APT tax reform will create winners and losers. The greatest beneficiaries will be those whose current level of taxes are considerably reduced, primarily wage and salary earners with modest financial asset portfolios. Those most likely to perceive themselves as losers are individuals and financial institutions closely associated with the business of exchanging property rights in financial assets and those who sell advice concerning legal circumventions of the current tax system. A single flat rate tax on all transactions permits the fiscal authority to exploit the fundamental discontinuity in the tax administration and compliance cost function that occurs at the point where all economic exchanges are taxed at the same low rate without deductions, exemptions or exceptions.2 Slemrod (1990); Bird (1992); Alm (1996) and Kaplow (1996) make clear that the design of optimal tax systems depend critically on considerations of administration, collection, compliance, and evasion costs. A new tax system that promises a radical reduction in these costs merits closer scrutiny. 3. ESTIMATING THE SIZE OF APT TAX BASE AND TAX RATE Under the APT tax proposal, the tax rate is reduced and the tax base is radically expanded beyond the conventional income tax base. First, all conventional deductions, exemptions and credits are eliminated. The base is further broadened by the inclusion of all voluntary wealth transfer exchanges of titles to assets and liabilities. 3.1. The Equation of Exchange The conceptual and empirical framework most useful for an analysis of a transactions tax system is Fisher’s (1909) famous equation of exchange: MV = PT , which establishes that the aggregate volume of payments (MV) must equal the aggregate volume of transactions (PT). M is the quantity of money used for making final payments defined as currency in circulation with the public plus all transaction deposits with financial institutions. V is the transactions velocity or turnover of the medium of exchange and represents a weighted average of the velocity of currency (Vc) and the velocity of deposits (Vd). Cash payments are estimated as CVc and checkable account payments are DVd, measured as debits to all transaction accounts. 3.2. Estimating the initial pre-tax APT tax base and the lower bound tax rate The APT tax proposes to impose a fixed tax rate (t) on the total volume of after tax payments, (MV) such that the required tax revenue R equals the product of the tax rate and the total volume of payments. The APT tax system is designed as a single comprehensive alternative to existing income and consumption based tax instruments. Being revenue neutral, the flat tax rate is chosen so as to raise the same amount of revenues R as the current tax system that it is intended to replace. The total volume of payments is endogenously determined by a complex set of behavioral responses that depend upon changes in the entire matrix of transaction costs throughout the economy. If we knew the aggregate elasticity of transactions with respect to transaction costs, and the effect of the APT tax reform on the matrix of transaction costs, we could determine the precise APT tax rate that would satisfy the revenue neutrality requirement. Since the aggregate elasticity of transactions is unknown we must first determine a lower bound for the APT tax rate. As a first approximation, we can estimate the lower bound APT flat tax rate (tˆ ) as: where the initial volume of payments, or the initial APT tax base is the before-tax volume of payments.

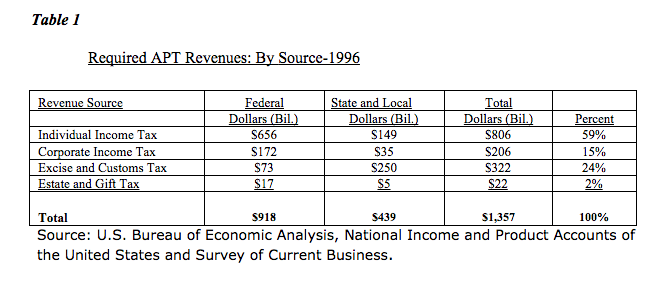

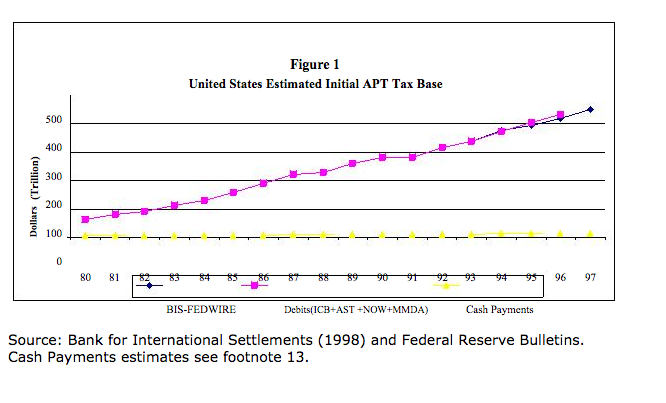

As a first step, we must determine the required revenue R . Table 1 displays the source of United States tax revenues that the APT tax is intended to replace. In 1996, the two major sources of federal and state revenues were the income taxes (74 percent) and excise taxes (24 percent).3 The revenue neutral APT tax designed to replace federal, state and local personal and corporate income, excise, gift and estate taxes would have been required to yield tax revenues of $1,357 billion in 1996. The initial APT tax base consists primarily of debits to transaction accounts, namely accounts that permit the settlement of claims by check, wire transfer or direct debit. Debits and credits to financial intermediary and brokerage transaction accounts are routinely recorded as part of the necessary business accounting practice of firms. For fiduciary establishments they are the essential means for determining and maintaining the current status of customer accounts. As such, the collection and aggregation of debit statistics impose relatively minimal reporting burdens on the financial community. The Federal Reserve had regularly recorded debit statistics since 1918. Garvey (1959) observed, “Probably no monetary statistics released by the Board of Governors of the Federal Reserve System are more widely reproduced than the debit statistics.” Unfortunately, this valuable historic series was discontinued in 1996. We employ two estimates of the payments (MV). The first is the Federal Reserve’s debit measure that includes debits to all insured commercial bank demand deposits and to other checkable accounts.4 The second measure is the Bank for International Settlements (BIS) estimate of the value of total payments adjusted for double counting made with various payment instruments.5 To these estimates of paperless payments we add an estimate of the total volume of cash payments made with US currency.6 These time series estimates are displayed in Figure 1, which reveals that cash payments make up only 3 percent of total payments. The rapid growth of final payments is due to a reduction in transaction costs brought about by innovations in communications and information technology. Between 1980 and 1996 the debits payment estimates show a 6.5 fold increase and in 1996, the APT tax base was 98 times larger than the income tax base as measured by the Internal Revenue Service’s estimate of Adjusted Gross Income (AGI). Given an estimated initial APT tax base in 1996 equal to some $ 445 trillion, and a required level of tax revenues of $ 1,357 billion, equation (1) permits estimation of the lower bound of the revenue neutral APT tax rate per transaction, which equals 0.30 percent. Thus each party to a transaction would be required to pay an APT tax of 0.15 percent.

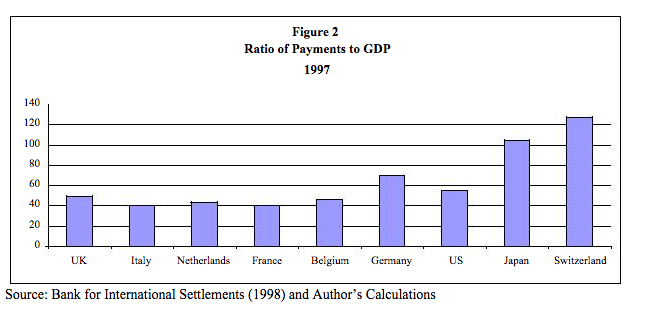

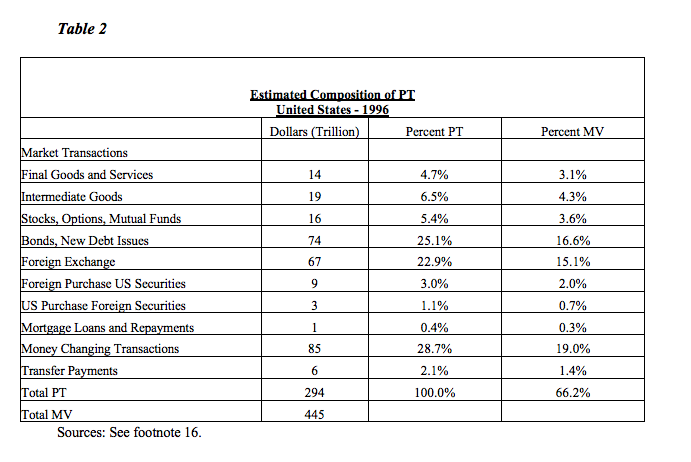

Although most of our empirical analysis is focused on the United States, it is interesting to obtain a rough impression of the potential APT tax base in other highly developed economies. Figure 2 displays the ratio of the volume of BIS payments (MV) to GDP for the United States, Japan and seven European nations. The figure is intended to provide a rough estimate of the ratio of the initial APT tax base to the income tax base as proxied by GDP. The ratios for Japan and Switzerland are roughly twice as high as that for the United States whereas the average of the other European countries is 13 percent below that for the United States. The figure suggests that the estimated revenue neutral APT tax rate for European countries would be slightly higher than that for the US whereas the revenue neutral APT tax rate for Japan and Switzerland would be lower than that estimated for the United States.7 3.3. Estimating the actual APT tax base and the APT tax rate Even a low APT rate of approximately 0.15 percent for each buyer and seller will provide an incentive to economize on the volume of transactions. What is required is an estimate of the elasticity (h) of total transactions with respect to aggregate transaction costs. Despite the fact that we live in the information age in which the most dramatic technological breakthrough has been the drastic decline in transaction costs, transaction costs have only recently been incorporated into theoretical economic analyses. As yet we have no systematic means of empirically measuring and tracking aggregate transaction costs over time. At best, we may be able to measure transaction costs in some particular markets and examine the available estimates of the elasticity of transaction volume to transaction costs in those specific markets. As a first step we disaggregate the transactions side (PT) of the equation of exchange into those transactions associated with: (1) the production of final domestic goods and services. (2) intermediate goods and services. (3) international trade. (4) exchanges of real and financial assets. (5) transfer payments. Each of these transaction categories roughly corresponds with entries in a national accounting system, thereby providing a useful starting point for classifying available empirical information. The transaction categories (1)-(5)correspond respectively to the transactions associated with: Gross Domestic Product Accounts (GDP); the Input-Output Accounts (IO); the Balance of Payments Accounts (BOP); the Flow of Funds Accounts (FOF)8 and the transfer portion of the Government Receipts and Expenditures Accounts. Employing data from these macroeconomic accounting systems and from specialized trade sources allows us to provisionally inquire whether MV equals PT. Table 2 displays our attempts to estimate the volume of transactions from identifiable transaction components.9 We have been able to account for roughly 66 percent of the payment estimates. Missing transactions from the (PT) side include all transactions in existing real assets such as exchanges of real estate, raw materials, art and commercial enterprises as well as exchanges, purchases or repayments of financial assets and liabilities that are not included in readily available macroeconomic accounting sources. Of the $ 294 trillion measured transactions, the largest components are money-changing transactions10, foreign exchange transactions and bond market transactions, which together make up approximately 77 percent of measured PT. All equity, options and mutual funds transactions account for an additional 5 percent of estimated PT and final and intermediate goods transactions together account for roughly 11 percent. Economists should be concerned about the dearth of information concerning the source of more than a third of recorded payments. Perhaps this is a shortcoming that national and international statistical organizations can remedy in the future, but it is certainly beyond the purview of the present paper.

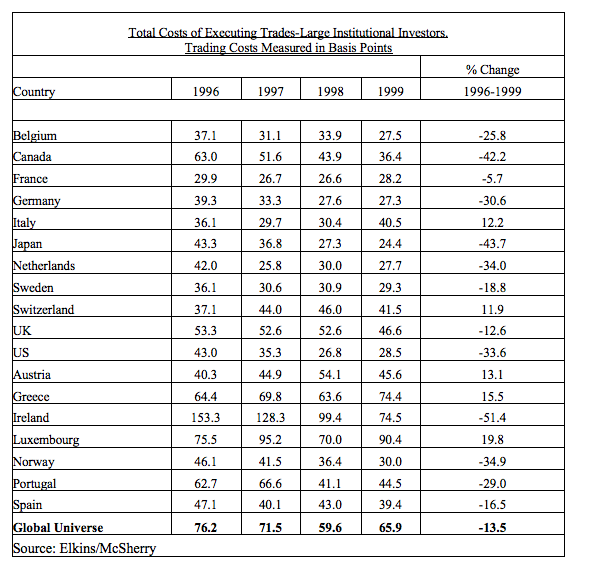

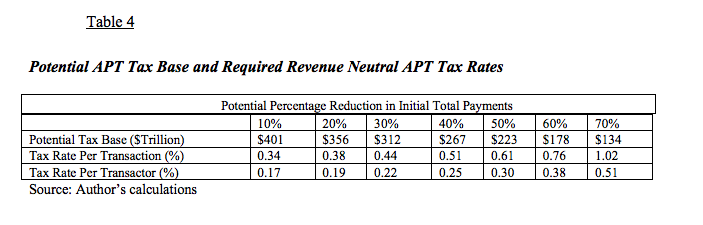

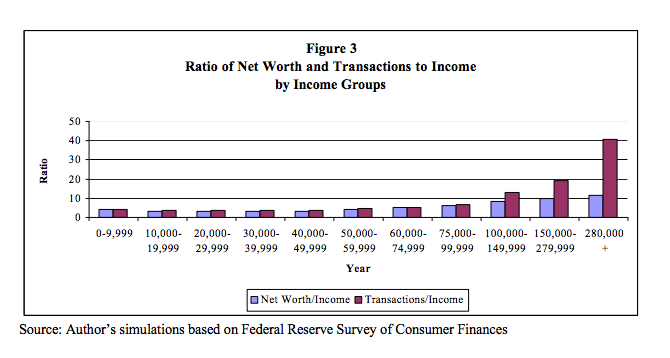

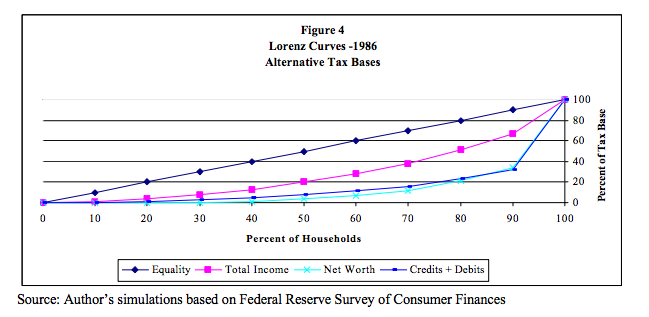

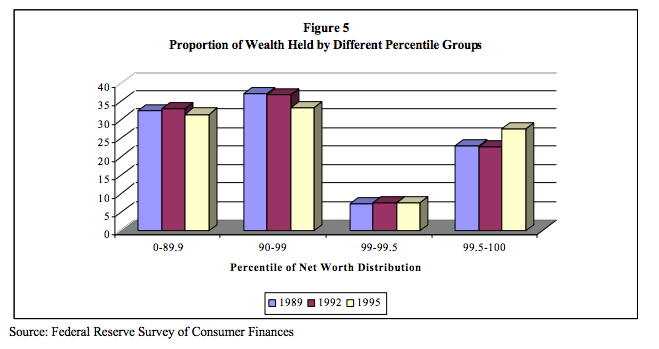

3.3.1 Equity market substitution effects. Our aim is to gain some insight into the extent to which initial total transactions are likely to decline in response to the introduction of an APT tax. Unfortunately, no one has ever attempted to estimate the elasticity of total transactions with respect to transaction costs, and so we must begin by examining research on trading volume effects in particular financial markets. The most careful, oft cited although somewhat dated estimate of the elasticity of equity trading volume to transaction costs in U.S. equity markets is (-.26) by Epps (1976). Jackson and O’Donnell (1985) estimate the transaction cost turnover elasticity on the London security exchange to be (-.70), while Lindgren and Westlund (1990) obtain an elasticity of about (–1.0) for the Stockholm stock exchange. Table 3 presents estimates of the total costs of executing equity trades by the largest institutional investors in Europe, Japan and the United States.11 Transaction costs for individual traders typically exceed the costs paid by large institutional investors. The table reveals that there exist wide disparities in trading costs for the large institutional investors in Europe. In 1999 these ranged from a low of 27.3 basis points in Germany to a high of 90.4 basis points in Luxembourg. Since 1996, equity-trading costs have declined in many countries, sometimes in excess of 40 percent. Table 3 Combining the transaction cost estimates reported in Table 3 and the aforementioned equity turnover elasticity estimates, we can simulate the equity market consequences of introducing an initial APT tax with a flax rate of 0.30 percent, that is a tax of 15 basis points for each buyer and seller in 1996. The simulated average percentage decline in equity trading volumes over all countries is 9 percent for the Epps elasticity estimate and rises to 33 percent for the Lindgren and Westlund estimate.12 Several factors suggest that the lower estimate is a more likely predictor of the actual consequences of introducing an APT tax. First, the primary determinant of elasticity is the number of available substitutes and there are fewer substitutes for all transactions than for any particular component of transactions. Therefore the elasticity for all transactions must be lower than the elasticity for equities in any particular market. Moreover, the aforementioned equity elasticity estimates were derived under circumstances where investors had many more substitution options than would be available under a universal APT tax. They could substitute taxed equities for equities traded in untaxed markets and they could shift their asset portfolio from taxed equities to any other untaxed asset.13 The breadth of the APT tax eliminates these substitution options and therefore implies a less elastic overall response. Continuing technology driven reductions in overall transaction costs and the elimination of existing taxes, particularly income and capital gains taxes, further mitigate the expected fall in total transactions resulting from the introduction of the APT tax. For example, consider a $10,000 equity investment yielding 8 percent per annum and held for 15 months, which was the average holding period for equities in the United States in 1998.14 Under an income tax system with a 30 percent marginal tax rate, the $1000 before tax earnings over the15-month period would be taxed $300 under the present system. Under an APT system with a 0.5 percent tax rate, the equity would be taxed $50 on purchase and $55 at the time of sale for a total tax cost of $110. The return on the average equity investment would be more attractive under the APT tax. The contrary would be true of bonds whose average holding period decline from 3.3 months in 1990 to 1.8 months in 1998. A $10,000 bond yielding an annual return of 5 percent and held for 1.8 months would earn $75 before the income tax and $68 after tax. Under the 0.5 percent APT tax the same investment would lose $25. In order to obtain the same return as under the present system, bondholders would have to double their holding period, that is reduce bond volume by roughly 50%. 3.3.2. Foreign exchange markets. The consequences of transaction taxes on foreign exchange (Felix, 1995; Spahn, 1995; Haq, et. al, 1996;) have been most widely discussed in the context of Tobin’s (1972) proposal to “ throw some sand in the wheels of speculation.” Annual foreign exchange volume in the US amounted to $ 67.3 trillion in 1996 and rose to $ 84.2 trillion in 1998. The volume of foreign exchange is made up of 42 percent in spot transactions, 11 percent in forwards and 47 percent in swaps. Perhaps 40 percent of this volume represents short-term trades of seven days or less. A 15-basis point APT tax on a security that turned over each week would amount to an annualized tax rate of roughly 15 percent; certainly enough to induce investors to substantially reduce trading volume and increase holding periods. Unfortunately, to date, there are no empirical estimates of the elasticity of foreign exchange trades that can be employed to obtain a prediction of the magnitude of the expected decline in foreign exchange volume. Felix, (1995) for example, assumes that a Tobin tax of 50 to 100 basis points would result in a reduction of 50 percent in trading volume. Since we have no firm basis on which to make such estimates, it is best to provide a sensitivity analysis that determines the revenue neutral required APT tax rate under different assumptions concerning the decline in overall transaction volumes. 3.4. The revenue neutral APT tax rate Table 4 displays alternative scenarios for the United States of the potential decline in the initial volume of total transactions (Figure 1) and the corresponding APT tax rates required to achieve the revenue neutral target of $1.357 trillion derived in Table 1. The simulation suggests that a 50 percent decline in the aggregate volume of initial transactions would require a revenue neutral APT tax rate of 0.30 percent per transactor. A massive 70 percent decline in initial transaction volume would raise the rate to 0.51 percent. A 70 percent decline in overall transaction volume would return the United States to the level of transaction activity that prevailed in the mid 1980’s For the remainder of the paper, for illustrative purposes, we shall assume that total transaction volumes decline by 50 percent as a result of the replacement of the existing tax structure with a revenue neutral APT tax. This will require a uniform flat rate on all transactions of 0 .6 percent divided equally between the buyer and seller of each transaction. Each party to a transaction would then pay 0.3 percent of the transaction value to the government. 4. ESTIMATING THE DISTRIBUTIONAL IMPACT OF THE APT TAX In order to gauge the distributional impact of the APT tax, it is necessary to estimate the distribution of payments made by different income classes. The strategy employed in this paper is to simulate the transactions patterns of U.S. households from their wealth composition as revealed in the Federal Reserve’s Survey of Consumer Finances. The 1986 survey contains estimates of the net wealth of households by income class and the composition of their net wealth by type of asset and liability. It also contains survey information on the number of times families in different income classes turned over particular assets. By applying turnover rates to each of the various asset and liabilities held in household portfolios of particular income categories, it is possible to simulate the volume of transactions (credits and debits) undertaken by households in different income classes. Figure 3 displays the simulated ratios of net worth to income and of transactions to income by income classes. It reveals that higher income groups hold not only a disproportionate share of net worth, but conduct a similarly disproportionate volume of transactions. Figure 4 displays the estimated Lorenz Curves for the distributions of total income, net worth and total transactions (credits and debits) based on the simulations for the 1986 Survey of Consumer Finances (SCF).15